Mad’a Investment Company, an influential Saudi firm, is the lead investor of the Bridge Round.

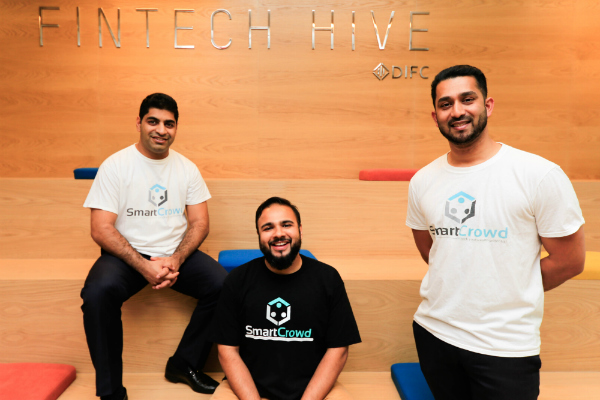

The bridge funding will enable the rapidly growing company to scale its operations, products and establish a presence in new markets including Saudi Arabia and Pakistan. The company recently closed a bridge round in excess of USD $ 3 million. The investor based grew 100% on a Q-o-Q basis. SmartCrowd, Dubai’s innovative real estate crowdfunding platform, which allows individuals investors to take a “fractional” share in a rental property, has grown its investor base nearly 6 times since the pandemic. The fresh funding will enable SmartCrowd to scale its operations, fine tune its product and expand into new markets including Saudi Arabia and Pakistan.SmartCrowd has so far funded more than 70 properties and processed transactions worth AED50 million.Founded in 2017 by Abdul Kadir Faizal, Musfique Ahmed and Siddiq Farid, Smart Crowd provides investors with access to real estate investment opportunities through its online platform.UAE-based real estate crowdfunding platform SmartCrowd, has raised a $3 million bridge round led by Mad’a Investment Company, with participation from TriCap Investments, Amaana Capital, the venture capital arm of US-based NRD Capital, along with a group of regional angel investors.

0 kommentar(er)

0 kommentar(er)